Camarilla Pivot Points for MetaTrader4 – download

In this section you can download Camarilla Pivot Points for MetaTrader:

Camarilla Pivot Points are interesting alternative for normal Pivot lines. They are mostly used by daytraders

About Camarilla Pivot Points – short introduction

Similar to normal pivot points, but it is more ready trading system. Created by trader Nick Stott in the end of 80’s it still being used by many traders.

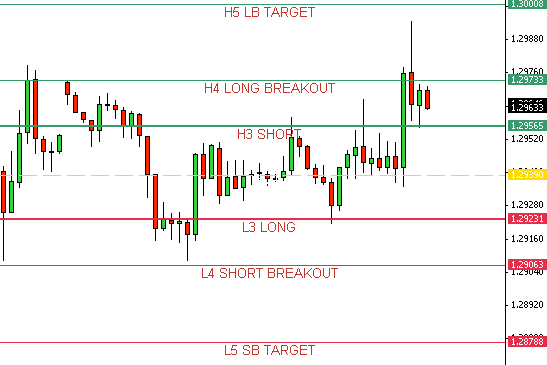

We have lines:

H5 – long breakout target H4 – long breakout

H3 – Short Pivot

L3 – Long

L4 – short breakout

L5 – short breakout target

So same as with pivot points, there is a middle line – pivot.

Camarilla lines

There are few strategies, based on that when a price was in the start of the trading day (London session). You should ream more about them to understand this approach to trading with Camarilla Pivot lines.

How to install Camarilla Pivot Points in Metatrader 4

About Camarilla Pivot Points, how to trade with Camarilla Pivot Points

In this section, we will look at a pivot point trading strategy that includes the Camarilla pivot point, a short-term moving average of the share price. It is a versatile indicator that allows traders to see the difference between a high and a low point on the market and a low and a high point on the stock market. The CamARilla pivot is a versatile indicator that allows trading in a variety of markets including the S & P 500, Dow Jones Industrial Average and NASDAQ 100.

The Camarilla Pivot Point alone is a strong and advanced pivot point that provides you with a precise entry and exit point for trading. It is a versatile indicator that allows traders to see the difference between a high and a low point in the stock market and the low and high point of a share price on a short-term moving average and NASDAQ 100. The CamARilla Pivot Point is one of the versatile indicators that enable trading in a variety of markets, including the S & P 500, Dow Jones Industrial Average, NASDAQ 100, and so on, which traders see as a good indicator of long-term gains and losses in the market.

For this reason, the pivot is able to put your trading strategy on steroids by finding a direction and improving your money management. It is ideal for short-term traders who want to speculate on small price movements and scalping.

In this article, we will look at some of the most popular pivots on the market, brands that can be divided into two categories: short-term and long-term pivots.

Considering that pivot points are predominantly used by day traders and are based on the current market price of the company’s stock and the market cap, here is how to calculate a pivot point. If you are an advocate of pivot points, you would take the value of your daily trading volume (i.e. the average daily volume) and divide by 3 and use that value as your pivot level for today.

If you are looking for a pivot forex trading strategy, the end value is the most commonly used, but it is the one you use in the Trading Strategies section that I have written about. If you look at a forex trading strategy with pivot points, the end value will be the most common and one that is most commonly used in your trading.

Now that we have understood the basic structure of pivot points, let us review some of the most common pivot point trading strategies and their final values. Follow me on Twitter (@ elias) for the latest news, analysis, tips and tricks, or follow us on Facebook for daily trading tips, tricks and tips on the best forex trading strategy for you and your friends. Follow me and follow them on Twitter (@ esaba) and Facebook for regular trading advice and advice on your preferred Forex strategies.

Most of the pivot point trading strategies used for swing trading are similar to the strategies I have just discussed above, but their end value is much higher than their original value. Some of these are more expensive than others, such as those in the table below and those in this article.

The Camarilla Pivot Point Trading strategy uses so-called classic pivot points, which suggest important levels of support and resistance to the trader. The Caminilla pivot point is a classic parquet dealer pivot point – a point that provides a dealer with key support and / or resistance levels. It is similar to the classic “floor trader” pivot points, which provide traders with important support and / or resistance levels. A Camanillaivot point must be a “classic floor dealer” that provides the traders with the key to support and – or – resistance.

At its core, pivot points serve as reference points, on the basis of which traders can assess changes in market sentiment. In this article, we learn how traders use Camarilla P-Pivot Points to identify trading opportunities and ride market trends. Next, you will learn how to trade Camanilla Pivots Trading and everything you need to know about the rules. To really understand how the CamARilla fulcrum is calculated, we first look at the standard fulcrum.

For many amateur traders, P – Pivot Points will clarify where to get in and out. Trading Camarilla P-Pivot points helps to determine levels of support and resistance, making it easier for traders to enter and exit the market. To identify trade entries, stop losses and make profits on each level, you must place a CamARillas P pivot point at the fulcrum.

With Camarilla P – Pivot Points, traders can find bear and bull zones for every day of the week. With different timeframes, a trader can set a trading strategy for the day, week, month and even year. Scalping and day trading with P-Pivot points are a good choice for traders who enjoy a shorter time frame. In different periods, trading with CamARillas and P-Pivot points can define a trading strategy for day, month and year or year-end.